July Stimulus Package – VAT Rate Reductions

– As part of July Jobs Stimulus Package, there will be a six-month reduction in the standard rate of VAT from 23% to 21%, from 1st September 2020 to 28th February 2021. July Stimulus Package – Vat rate reduction from 13.5% to 9% – The VAT rate for the tourism and hospitality sector will drop […]

Employment Wage Subsidy Scheme – Key Points for Employers

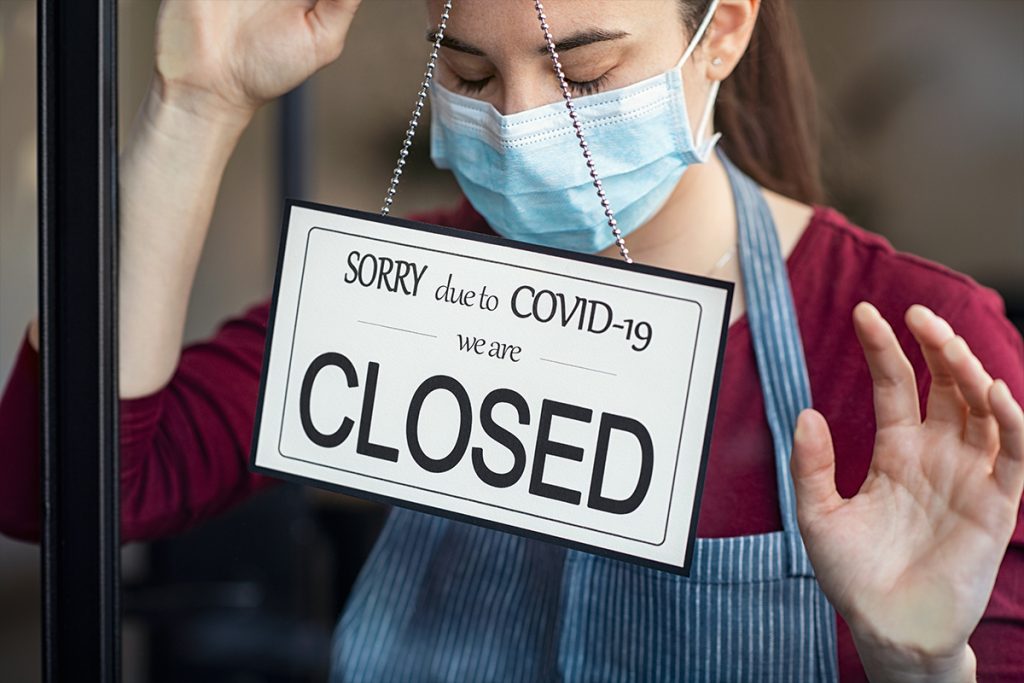

The COVID -19 Temporary Wage Subsidy Scheme (TWSS) will cease on 31st August 2020 and will be replaced by the new Employment Wage Subsidy Scheme (EWSS) which will come into effect on 1st September 2020 and run until 31st March 2021. There are 2 elements to the EWSS: a) Qualifying employers can claim back a […]

€1,000 Sole Trader / Self-Employed Enterprise Support Grant COVID-19 support for Micro-Enterprises

The Grant applies to those self-employed individuals that do not pay commercial rates and hence did not qualify for the initial Restart Grant Plus Scheme The Grant is a once-off support for self-employed individuals who have been severely impacted and have had to cease operations as a result of the pandemic and have since reopened […]

Audit Exemption for Small Companies & Micro Companies

A small company is a company that meets two of the three following criteria; Balance sheet total does not exceed €6m Turnover does not exceed €12m Number of employees does not exceed 50 A micro company is a company that meets two of the three following criteria; Balance sheet total does not exceed €350,000 […]

Register of Beneficial Ownership

Obligation to File and Maintain Beneficial Ownership Information before deadline date 22 November 2019 The European Union (Anti-Money Laundering: Beneficial Ownership of Corporate Entities) Regulations 2019 (SI 110 of 2019) (“the Regulations”) were signed into law in March 2019. Under the Regulations, companies in Ireland are obliged: to obtain, file and hold details of […]